PurchasePower

A mobile app that helps people improve their credit products affordability

01 Brief

Objective

Open Banking is a regulation launched 2 years ago in the UK, which allows the user‘s different bank accounts to be integrated into one platform.

With the capabilities of sharing financial data in seconds, I aim to define opportunities for niching innovation in digital banking with a commitment to personal data ownership for user conversion and customer success.

Outcome

Project being supported by and shared with Bud, a financial ecosystem builder.

Validated by user test and expert interview.

My Role

As a self-direct project for Master Degree, Service Design at the Royal College of Art,

I take the role of product owner: responsible for stakeholder management, concept development, business design, and demo prototype(UI on this page).

During: Feb-July, 2020

02 Challenges

How might we

Help Young Professionals Clarify and Improve Affordability to

Get the Best Deal for Credit Products?

Clarify the

Affordability

1

product proposition

Communicate large chunks of complex data into easily digestible formats to keep track of spending, income, and budgeting.

design challenge

2

product proposition

Personalised Loan Recommendation

Tailor the filter options that fit customers' touchpoints, win their trust, and turn it into decision-making. Weaken the awareness for the "role of broker"

design challenge

3

Nudge Financial Behavior

product proposition

Humanise the Artificial Intelligence and bespoke the tone of voice, break down the goal into actionable small tasks engage customer

design challenge

1

Clarify

Affordability

Dynamic Personalised Module based on Classified Financial Behaviors

2

Personalised Loan Recommendation

Tailored Filter Setting and Predicted Best Deal Recommendation

3

Nudge Financial Behavior

Bespoke Chatbot Provides

Actionable Tips and Engaged Progress Tracking

03 Value Network

For Customer

04 Process Management

Regulation-led Innovation

As a human-centered product service based on the regulation change, the biggest challenge we faced is how to leverage the opportunities that match the customer’s needs and aspirations.

We dig deep into the discovery phase, launch the expert interview and user research at the same time. Synthesise insights across findings through rapid prototyping of assumptions to diagnose the niche point.

Data Driven Design

I request my data from Monzo, and use Python to diagnose my personal consumption patterns from the transaction data in order to better understand my financial behaviour.

My belief is that getting the insights from data and engaging in deep informative conversations with the interviewees, in order to understand the attitudes and reasons behind the "screen" and "action", would help elevate the user research to the next level and with generating product strategies.

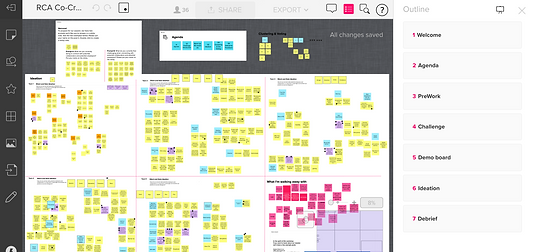

Design during Pandemic

Although the video call interview can’t let us “read the air”, really get their facial expression and body language, we design and develop digital toolkits to help the interviewees keep focus and stay in their comfort zone so that we can better get empathy with them.

We use an online collaboration platform like Miro for co-working, sharing any sketch immediately like working in studio.

2

05 Key Takeaway

Humanise Artificial Intelligence

1

People have various views on what the role of a chatbot should play and it's characters, even they might from the same demographic and with the same observed behaviors. So a tailored communication strategy should be made case by case with the power of machine learning.

Human-centered design should be involved in the algorithm development that bespoke the tone of voice.

2

Win Customer Trust Through Dynamic Propositions

People are losing trust in banks. it’s even challenging to make them trust a FinTech product. Our product strategy is a dynamic approach. Be a professional tool first, that accomplish the task, then provide information beyond customer’s needs, in the end, take the role of assistant, bring more humanist into the customer relationship

3

Impact Measurement Metric

The impact of a service/product is to be measured through the same touchpoint that delivered value to users.

In this case, the evidence comes from customer reaction with the chatbot and his transaction pattern change.

Improve affordability for the loan he wants? Does he get the loan successfully in the end? be more confident for the financial future.